Financial Information to have when Preparing for Divorce in New Jersey

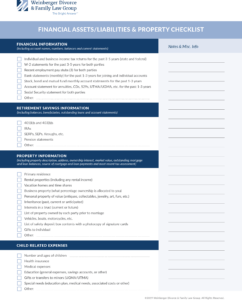

The best ways to begin preparing for your divorce? Identifying your goals regarding your children, and gathering together your financial information. Getting your personal finances organized, both as a way for you to better understand your financial situation and to have the needed documents on hand to show your divorce attorney, helps you feel more prepared. To help you get started, download and print out our multi-purpose, helpful Financial Information Checklist to start keeping track of your assets, liabilities and expenses.

The best ways to begin preparing for your divorce? Identifying your goals regarding your children, and gathering together your financial information. Getting your personal finances organized, both as a way for you to better understand your financial situation and to have the needed documents on hand to show your divorce attorney, helps you feel more prepared. To help you get started, download and print out our multi-purpose, helpful Financial Information Checklist to start keeping track of your assets, liabilities and expenses.

As you go about organizing your bank statements and other records as part of your financial information housekeeping, here is a list of some items to make copies of if you have plan to file for divorce in New Jersey:

Records of income and investments for the past one to three years, including:

- W-2 statements for both you and your spouse,

- recent pay stubs (the most recent three should suffice),

- rent receipts for any investment property,

- state and federal individual and business income tax returns,

- monthly or quarterly statements for all financial accounts owned jointly, individually, or in trust, by you, your spouse, or any of your minor children – examples include bank accounts, mutual fund accounts, retirement or pension accounts, annuities, securities, certificates of deposit, and 529 accounts – and

- current social security statements for you and your spouse.

Documents demonstrating bills and outstanding debts for the past one to three years, including:

- property tax statements,

- mortgage or home equity loan statements,

- credit card statements (both joint and individual),

- vehicle or equipment leases,

- tax liens or notices from the IRS,

- bills for utilities, household maintenance, or other services,

- medical bills not covered by insurance,

- student loan documents or tuition bills,

- spousal or child support orders from a prior marriage, and

- any other loans or notes payable.

Documents demonstrating or potentially affecting property ownership, such as:

- any pre-nuptial or post-nuptial agreements,

- deeds and purchase documents for your primary residence and any other real estate owned by you or your spouse,

- any family-owned business agreements, and ownership documents for any business property owned partially or fully by either you or your spouse,

- appraisals or purchase documents for any personal property of substantial value (antiques, jewelry, artwork, etc.),

- title documents or registration certificates for your automobiles or other vehicles,

- evidence of insurance (health, long-term care, disability, life, auto, and homeowners),

- wills or trust documents affecting you, your spouse, or your children, and

- documents demonstrating separate ownership of any property by either spouse, such as evidence that property was individually owned prior to marriage, or inherited.

This list may seem daunting, but keep in mind that you are going to need complete and accurate evidence of exactly what you and your spouse own, what income is coming into the household, and what expenses are going out – all assets and debts. This information will be the basis for fairly dividing your property and debts and for deciding whether or not one of you will pay alimony or child support to the other, and if so, how much and for how long.

Divorce can be a confusing, but heading into it with a solid grasp of where you stand financially can ease some of the anxiety and uncertainty. Should you be ready to start divorce proceedings or have questions about your financial situation in divorce, please contact us, at Weinberger Divorce & Family Law Group, LLC, for an initial consultation.